Financial Advisor Awards 2012-13 : Jury Meet

Presentation by Ajay Sipani

• A Manager in a pharmaceutical company turned into a Financial Advisor in the year 1997.

• The present day advisory is solely driven by me and has over the years evolved into a more holistic advice based. The mutual fund business is covered under 2 ARNs; 2733 and 2368.

• Profession started with a Rs. 5,000/- application from a particular client who now gives a single application of Rs. 5,00,00,000/-

• We understand that only Long Term Investments can help reach Financial Goals.

• Today we have Clients spread across the entire Globe

• Possession of a strong exclusive HNI &NRI clientele Base

• We offer our Clients specialized advice & services under :-

- Mutual Funds,

- Fixed Income,

- Insurance,

- Retail Investments

• We are registered with Association Of Mutual Funds in India (AMFI)

• We are registered with the Insurance Regulatory & Development Authority (IRDA).

• We are registered with Small Savings Organisation Government of India (GOI).

• We pursue and believe in policies of diversification and offer our clientele a comprehensive range of products :-

- Mutual Funds

- Fixed Income Securities comprising Govt. Securities

- PSU Bonds

- RBI Bonds

- Post Office & Fixed Deposits

- Primary Market issues

- Insurance ( Life & General )

• We are affiliated to all the Financial Institutions and Asset Management Companies like:-

- ICICI Prudential

- UTI

- SBI

- Franklin Templeton

- HDFC

- IDBI

- TATA

- BIRLA SUNLIFE

- J P MORGAN

- Kotak

- HSBC

- Life Insurance Corporation of India

- The Oriental Insurance Co. Ltd.

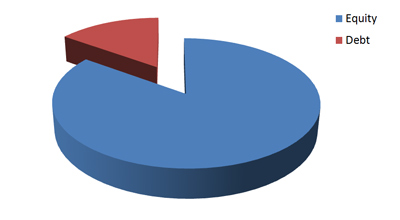

• From the above slide it may be noted that the 85 percent of AUM or Portfolio consists of Equity Component.

• The average age of the mutual fund assets is 5 to 6 years.

• The average returns on the portfolio is a tax free 12% to 18%.

- KEY CLIENTS

- High Net Worth Individuals

- Non Resident Indians

- Small and Medium Enterprises

- Retail Investors

• We pursue and believe in policies of diversification and offer our clientele a comprehensive range of products :-

• Personalised Contact and Service to the Clients

• Daily updates on the Market Activities and emanating information

• Continual Process of Advising

• Heading Group of Leading Financial Advisors in the City resulting in to :-

- Collective Wisdom and Collective Knowledge

- Access to Different views through debate and interactions

- Improved Decision Making Qualities

- Collective Well-being of all – Distributors and Investors

- CEO, CFO and Sr. Managements of SMEs, Companies

- CEO and Fund Managers of Various Asset Managements Cos.

• A cautious and conscious approach is taken for amalgamation of online application in the system.

• Patiently waiting for stabilization of Technology and Innovation before using it for the clients (ATM withdrawals – Resource Vulnerability)

• Using all websites and other tools for procurements and analysis of information to make business processes and decision faster,accurate and appropriate.

• GROSS SALES Rs. 50-60 Crores INR Per Year

• NET SALES Rs. 30-40 Crores INR Per Year

• Adherence to the Role of Financial Advisory

• Understanding the Profile & the Need of the Client

• Balancing and Rebalancing of Portfolio according to the Market

• Safety First Approach

• To aim at reaching and securing the Financial Goals of the Clients

• Confidence Building

• Referral Value Enhancement

• ICICI Pru Chairman Club Award – 1998 till 2011 – Every Year

• UTI Mutual Fund Chairman’s Club - 2010-11 & 2011-12

• Reliance Mutual Fund Platinum Partner Award

• HDFC Upper Crust Award - 2008 till 2011 - Every Year

• SBI Mutual Fund Special Merit Award

• Birla Mutual Fund Platinum Partner Award

• HSBC Mutual Fund Masters Award

• DSP BlackRock Mutual Fund Preferred Partner

• Franklin Templeton Funds Diamond Partner

• There are several contest winning awards of different Mutual Funds & LIC

• Taking initiative in educating the HNIs, NRIs - how to convert their savings into meaningful financial investments so that long term wealth is created

• I undertake Continuous self upgradation by undergoing regular educational and development programs

The motto of ours is to assist our clients to achieve their long term financial goals without compromising on quality service.